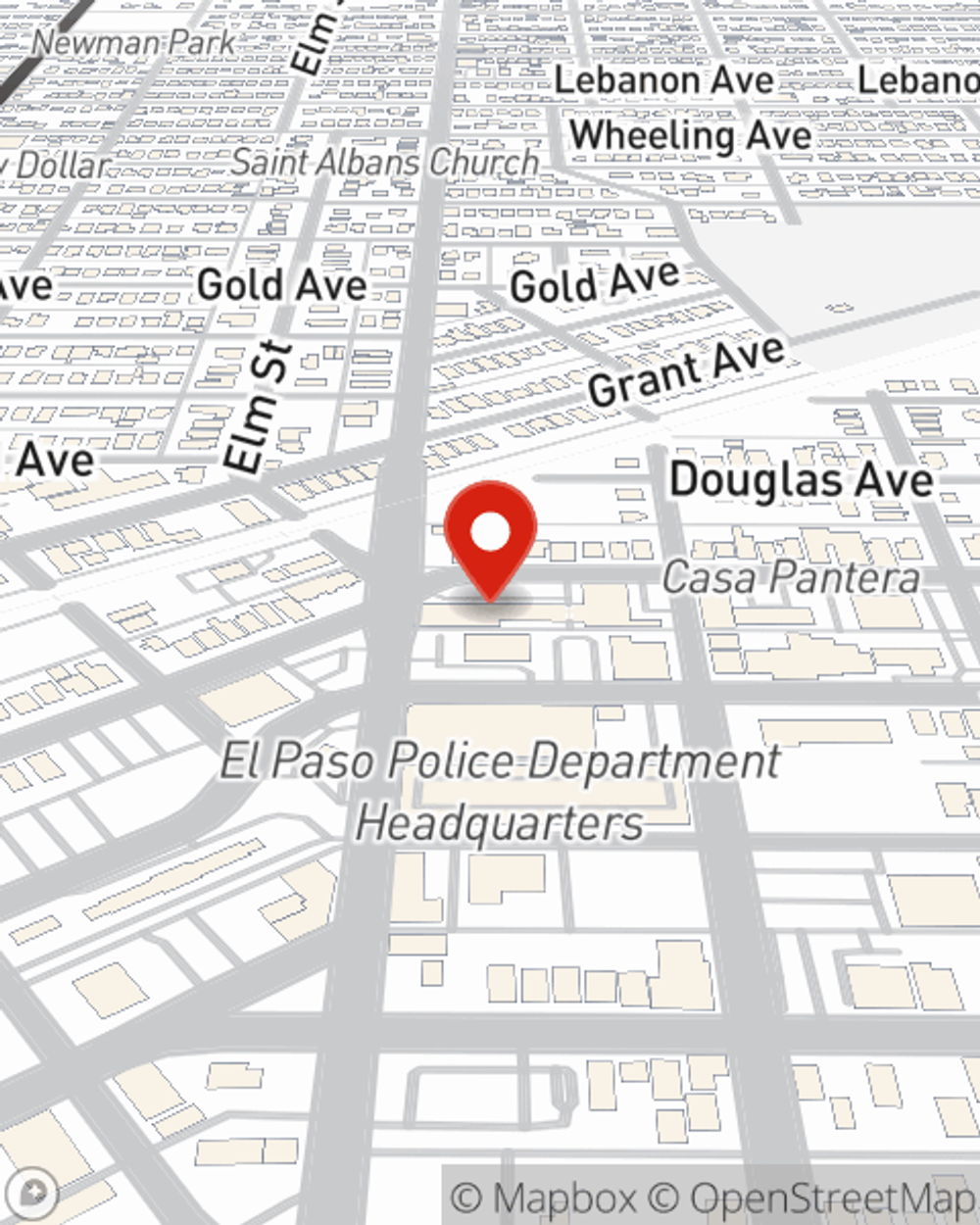

Business Insurance in and around El Paso

One of the top small business insurance companies in El Paso, and beyond.

Helping insure small businesses since 1935

This Coverage Is Worth It.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes problems like an employee getting injured can happen on your business's property.

One of the top small business insurance companies in El Paso, and beyond.

Helping insure small businesses since 1935

Get Down To Business With State Farm

Protecting your business from these possible accidents is as easy as choosing State Farm. With this small business insurance, agent Paul Rosales can not only help you devise a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

Take the next step of preparation and call or email State Farm agent Paul Rosales's team. They're happy to help you research the options that may be right for you and your small business!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Paul Rosales

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.